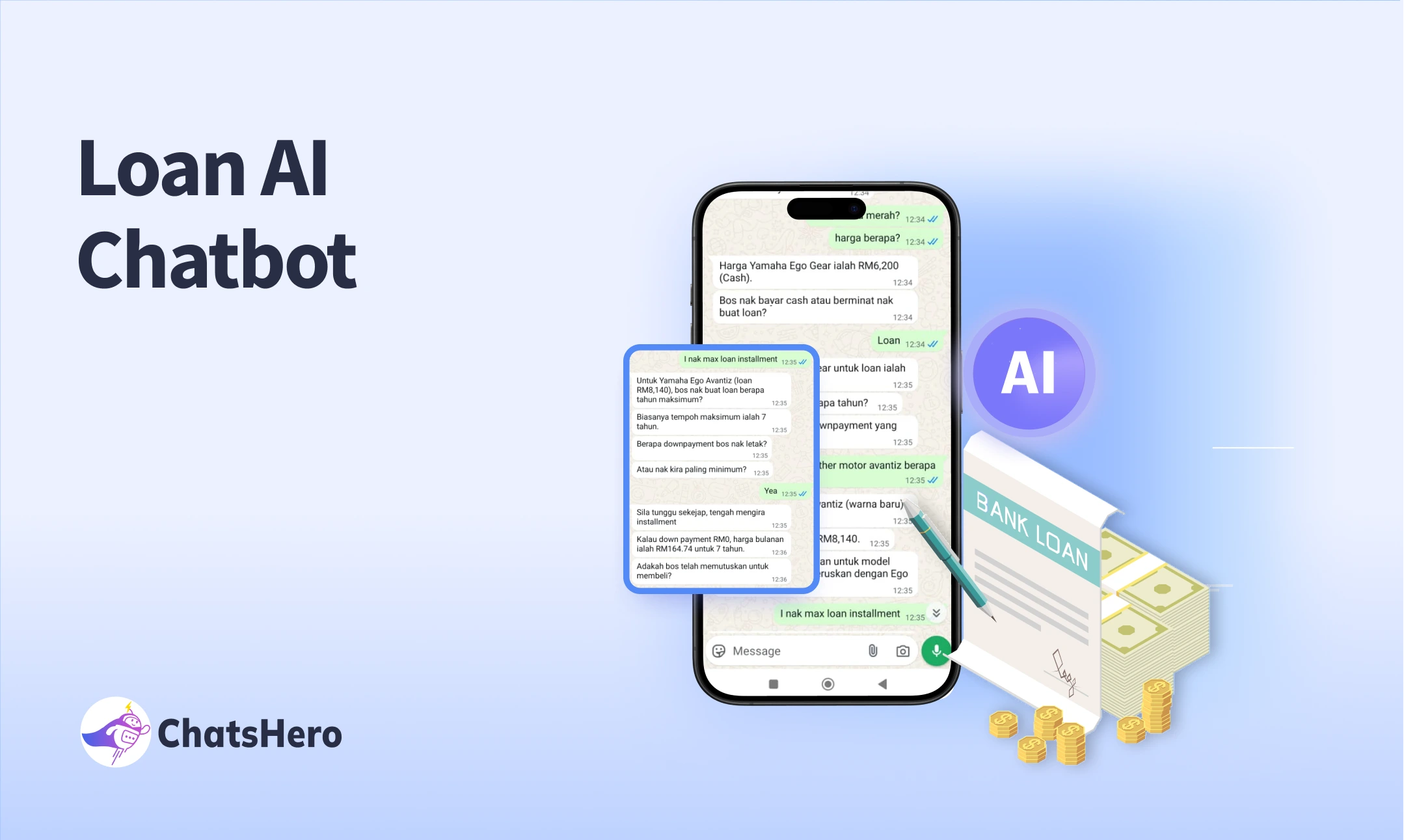

Loan AI Chatbot: Automating Loan Inquiries with Smart AI Guidance

In today’s digital era, loan applicants expect fast responses, clear guidance, and seamless application experiences seamless application experiences. Traditional manual processes often lead to delays, missed follow-ups, and high operational costs.

That’s where the Loan AI Chatbot comes in — a smart assistant that handles every step of the loan inquiry and qualification process, from data collection to document submission, all automatically.

Provide Step-by-Step Guidance

The Loan AI Chatbot acts as a virtual loan consultant, walking applicants through each step — from choosing loan types (personal, car, home, or business) to completing their application. Users no longer need to guess what comes next; the chatbot offers clear instructions, ensuring higher completion rates.

- Reduces confusion

- Improves user experience

- Ensures data completeness

Example:

“Let’s get started! What type of loan are you looking for? Once selected, I’ll guide you through your application.”

Benefits:

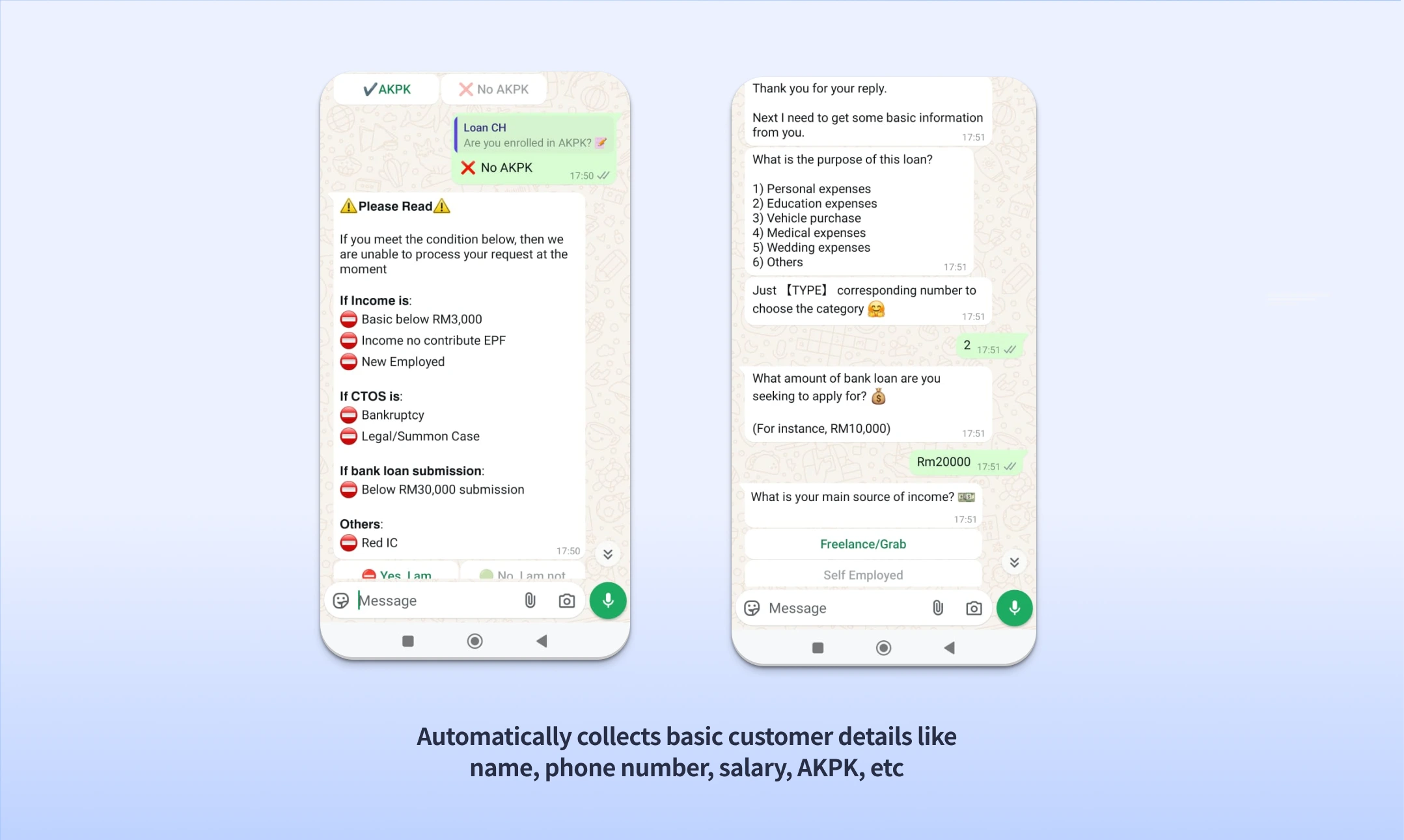

Collect Applicant Information (Salary, Age, Employment)

The chatbot intelligently collects essential applicant data such as:

- Monthly income

- Age range

- Employment type (full-time, self-employed, etc.)

With AI-based validation, it ensures all inputs are accurate and complete before moving forward.

- Example:

“Please enter your monthly salary so I can check your eligibility.”

Benefits:

- Structured data collection

- Eliminates manual errors

- Speeds up qualification process

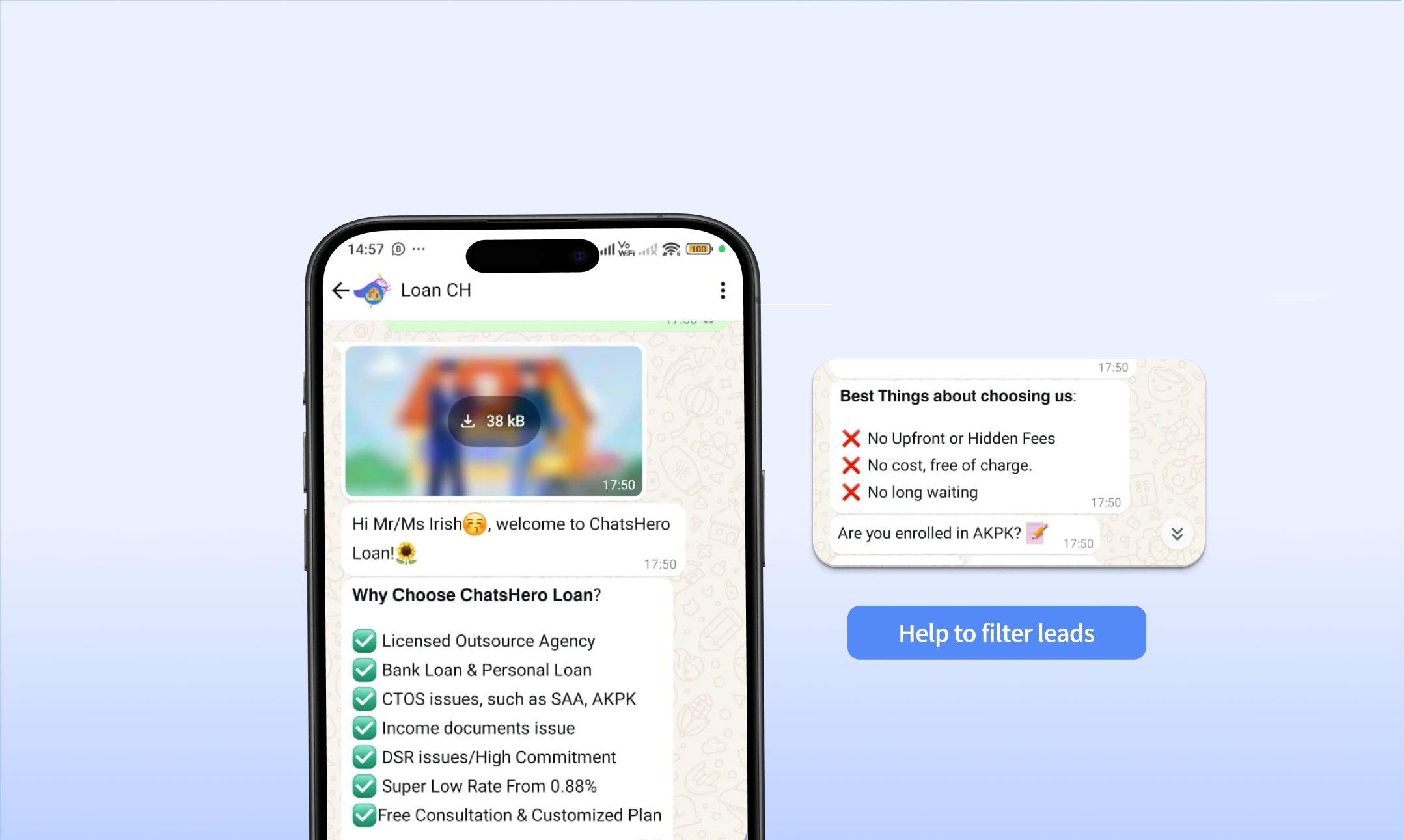

Filter Out Not Eligible Applicants

Once data is gathered, the chatbot applies eligibility filters (like income thresholds, age, and employment criteria) to determine if the applicant qualifies.

Ineligible applicants receive polite suggestions:

“Based on your information, you might not qualify for a RM50,000 loan. Would you like to explore smaller loan options?”

Benefits:

- Saves agent time

- Focuses on qualified leads

- Improves conversion rates

Collect Potential Lead Data into Google Sheets

Every applicant’s data is automatically stored in Google Sheets or your CRM system for tracking and follow-up. This integration ensures real-time data synchronization, allowing your sales or loan officers to review and act on leads instantly.

Benefits:

- Centralized lead management

- Easy reporting and analysis

- No manual entry required

Use AI to Collect Applicants’ IC & Payslip

The chatbot prompts users to upload required documents such as:

- Identification Card (IC)

- Payslip or bank statement

AI checks whether files are uploaded correctly and flags missing documents.

-

Example:

“Please upload your latest 3-month payslip to proceed with the loan application."

Trigger AI Flow (Not Based on Keywords)

Unlike rule-based bots, the Loan AI Chatbot uses intent recognition — it understands context, not just keywords. For example, even if a user types, “I want to borrow money for my business,” the chatbot knows to trigger the business loan flow automatically.

Benefit:

- Smarter conversation

- More natural user experience

- Higher accuracy in routing

Conclusion

The Loan AI Chatbot isn’t just a tool — it’s your digital loan assistant. From collecting data to filtering leads and answering FAQs, it automates the entire process, ensuring efficiency, accuracy, and 24/7 customer engagement.

your loan process today with a smart AI chatbot and never miss a lead again.

Frequently Asked Questions

1) Can the chatbot handle multiple loan types?

Yes, it supports personal, business, home, and car loans with separate flows.

2) Is my data secure?

All collected data is encrypted and stored securely following ISO 27001 standards.

3) Can it integrate with Google Sheets or CRM?

Yes, it syncs applicant data automatically for tracking and reporting.

4) Does it support multiple languages?

Yes, it can reply in English, Malay, and Chinese using AI translation.

Further Reading

Want to learn more about automations for your business? Check out these resources: